Trends in Mobile Payments: Shaping the Future of Transactions

As the mobile payments industry continues to evolve, several key players have emerged as leaders in the field. Companies such as Apple, Google, and Samsung have established themselves as major players, offering popular mobile payment platforms like Apple Pay, Google Pay, and Samsung Pay. These tech giants have revolutionized the way consumers make transactions, providing a convenient and secure way to pay for goods and services using their smartphones.

In addition to these tech giants, financial institutions like Visa and Mastercard have also played a significant role in shaping the mobile payments landscape. By partnering with mobile payment providers and implementing innovative technologies, these companies have helped to drive the adoption of mobile payments around the world. With their vast networks and expertise in the financial industry, Visa and Mastercard are key players in ensuring the security and reliability of mobile transactions.

The Rise of Contactless Payments

Contactless payments have rapidly gained popularity across the globe in recent years. This surge can be attributed to the convenience and speed they offer to consumers during transactions. With just a simple tap or wave of their mobile device or card, customers can swiftly complete their purchase without the need to swipe or insert a card into a reader.

Businesses of all sizes are increasingly adopting contactless payment technology to cater to the growing demand from customers. From small retail shops to large corporations, the shift towards contactless payments is reshaping the way transactions are conducted. In addition to the ease of use, contactless payments also provide businesses with a secure and efficient payment method that enhances the overall shopping experience for their clientele.

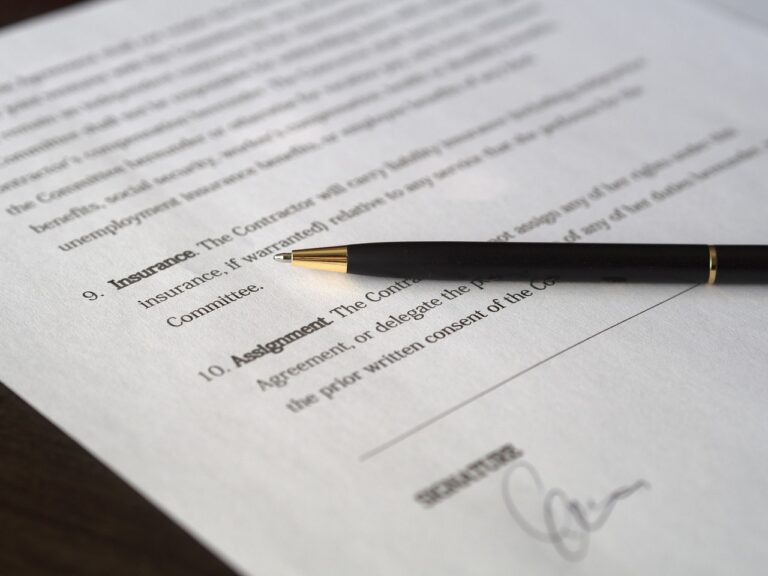

Security Measures in Mobile Transactions

When it comes to mobile transactions, security is a top priority for both consumers and businesses. One key security measure in place is biometric authentication, which uses unique physical characteristics such as fingerprints or facial recognition to verify the user’s identity.

Another important security measure is tokenization, where sensitive data like credit card numbers are replaced with random “tokens‿ during the transaction process. This helps to protect the actual card information from being intercepted by hackers. Additionally, encryption technology is widely used to encrypt data exchanged between the mobile device and the payment processor, ensuring that sensitive information remains secure during transmission.

• Biometric authentication is a key security measure in mobile transactions.

• Tokenization replaces sensitive data with random tokens to protect information from hackers.

• Encryption technology encrypts data exchanged between the mobile device and payment processor for added security.

What are some security measures in place for mobile transactions?

Some common security measures include encryption of data, tokenization of payment information, biometric authentication, and two-factor authentication.

Are mobile payments secure?

Yes, mobile payments are generally considered secure due to the various security measures implemented by mobile payment providers and financial institutions.

How can I protect my mobile payment information?

To protect your mobile payment information, you should regularly update your mobile payment app, use secure networks when making transactions, avoid sharing your payment information with unknown sources, and enable security features such as biometric authentication.

What should I do if I lose my mobile device with my payment information stored on it?

If you lose your mobile device with your payment information stored on it, you should contact your mobile payment provider immediately to report the loss and have your information disabled or wiped remotely.

Is it safe to use public Wi-Fi for mobile transactions?

It is generally not recommended to use public Wi-Fi for mobile transactions as these networks may not be secure. It is safer to use a secure and private network for making mobile payments.